2025 Market Review & 2026 Key Themes

With Special Update: Venezuela, Oil, and Portfolio Implications

January 8, 2026

Markets finished 2025 in strong shape, rewarding investors who stayed disciplined despite persistent uncertainty. Equities gained globally, bonds rebounded, and international markets outperformed U.S. stocks in a notable shift from recent years.

Looking ahead, 2026 begins with a constructive but more complicated backdrop: stock valuations are elevated, economic growth is moderating, the Federal Reserve is shifting policy, and geopolitical risks remain headline catalysts. At the same time, broadening market leadership and renewed diversification benefits are healthy signals for long-term investors.

Finally, recent developments in Venezuela—including the detention of President Nicolás Maduro and renewed U.S. involvement—have raised investor questions about energy markets and geopolitics. History suggests these events may create short-term market fluctuations, but rarely change long-term market trajectories. The clearest channel of impact remains oil prices, though any meaningful increase in Venezuelan production would likely take time.

2025 Year in Review: A Strong Year That Reinforced Discipline

Despite a year filled with headline risk, including trade policy shifts, ongoing geopolitical tensions, and continued debate over interest rates, 2025 delivered exceptionally strong performance.

Key takeaway: Market uncertainty is normal, but long-term investors have historically been rewarded for maintaining discipline rather than reacting to headlines.

2025 Market Highlights:

U.S. equities posted strong gains, with the S&P 500 rising 17.9% including dividends.

International equities led the way, supported by a weaker U.S. dollar and improved sentiment globally.

Fixed income rebounded meaningfully, providing both return and diversification benefits.

Volatility spiked at points during the year, but markets repeatedly stabilized and moved higher.

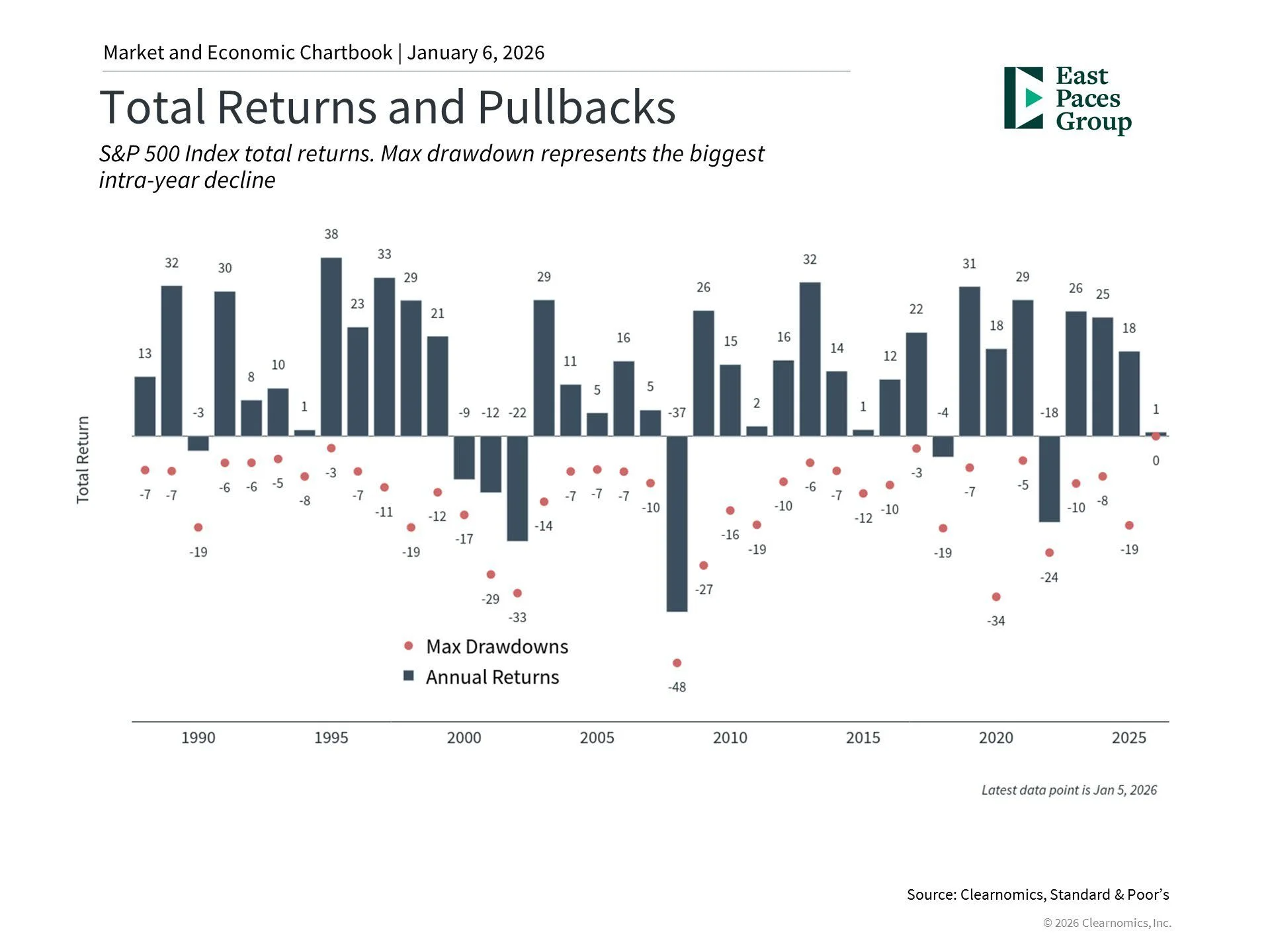

This chart (left) shows total returns of the stock market (bars) and the largest intra-year decline (dots) each year. Numbers are percentages.

The average year sees a significant intra-year drop. However, most years still end in positive territory, especially with dividends. Volatility in prices is a normal part of investing.

2026 Outlook: Seven Key Themes for Investors

2026 begins after an extended run of strong market performance. That strength is positive—but it also raises reasonable investor concerns about valuation, concentration, and the likelihood of more volatile or moderate returns ahead.

Instead of attempting to forecast a single path, a better approach may be to evaluate themes that have the potential to shape markets across multiple possible outcomes.

Diversification is Working Again

Returns are increasingly coming from multiple sources—international stocks, bonds, and broader equity participation—not just a narrow set of U.S. mega-cap leaders. Balanced portfolios are better positioned for a wider set of outcomes than concentrated strategies.

2. Valuations Are High — Which May Moderate Forward Returns

U.S. equity valuations remain elevated, approaching levels last seen during the late 1990s. This does not guarantee a market decline, but it does suggest future returns may be more moderate and markets may react more sharply to disappointments.

3. AI Remains the Biggest Force in Markets (and the Biggest Question)

AI continues to drive corporate investment and market narratives. The key question isn’t whether AI will transform the economy, but whether current valuations reflect realistic timelines for widespread profitability.

4. Growth is Moderating, but Still Positive

Economic growth has slowed but remains resilient. Investors will watch whether productivity increases—possibly driven by AI—can sustain growth even amid higher rates and evolving demographics.

5. Tariffs Remain a Policy Wildcard

Tariffs created volatility in 2025. While the longer-term impact has been less disruptive than feared, trade policy can re-emerge as a market narrative that affects sentiment quickly.

6. Fiscal Policy, Debt, and Elections Will Drive Headlines

Government funding debates, deficits, and the midterm election cycle will continue to stoke political and market uncertainty. Historically, investors who make major portfolio shifts based primarily on political fear have often regretted it.

7. The Fed Still Matters — and Leadership Change Adds Uncertainty

The Fed resumed rate cuts in late 2025, and policy expectations will remain front and center. Added uncertainty comes from the upcoming leadership transition as Powell’s term ends in May. Long-term yields are shaped by broader forces like inflation expectations and global growth.

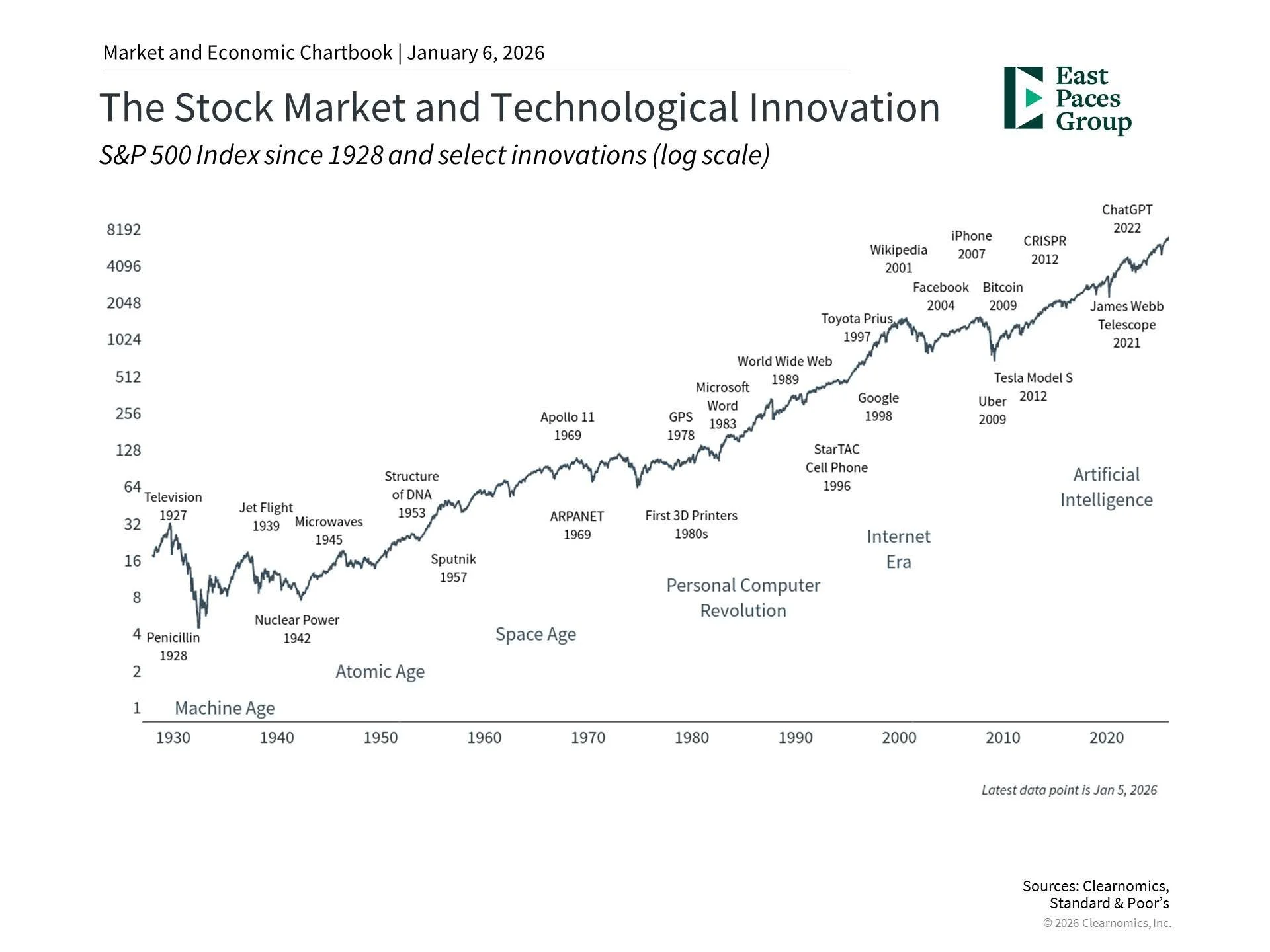

The chart to the right shows that continued innovation and increases in productivity growth are key to long-term market and economic growth. However, the stock market has not moved up in a straight line with past innovations, and many effects of innovation can take years to materialize.

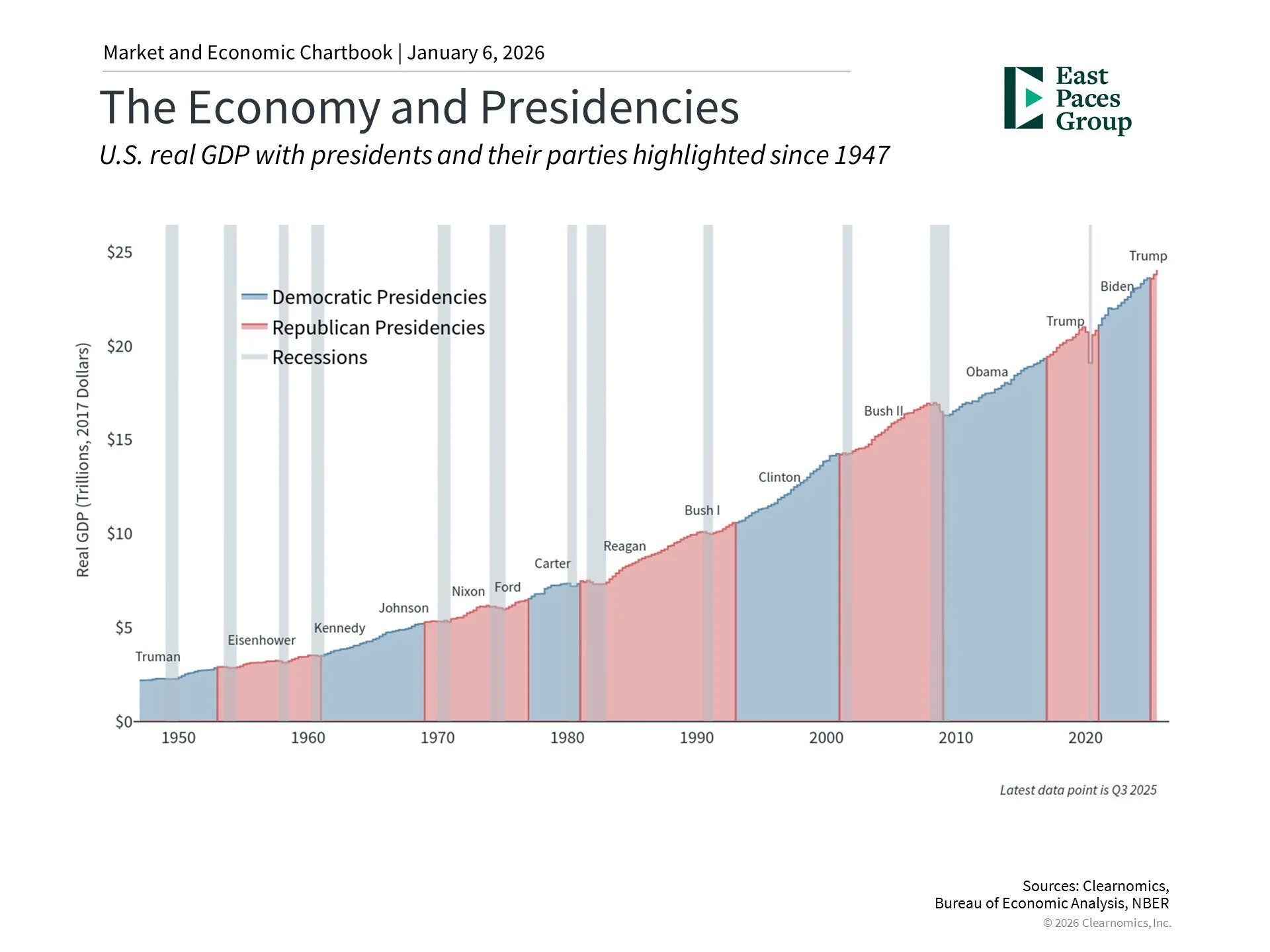

This chart (left) shows the economy has grown steadily since World War II across both major political parties. This may seem unintuitive to many investors due to how each party is portrayed when it comes to economic policy. The reason for this pattern is that business cycles are impacted by many factors beyond the party in the White House.

Special Update: Venezuela, Oil, and Portfolio Implications

Recent reports involving the detention of Venezuelan President Nicolás Maduro by U.S. authorities represent a meaningful geopolitical shift with humanitarian and regional consequences. Market participants, however, often focus on how such developments could affect portfolios.

Historical Reality: Markets Often Recover Quickly from Geopolitical Events

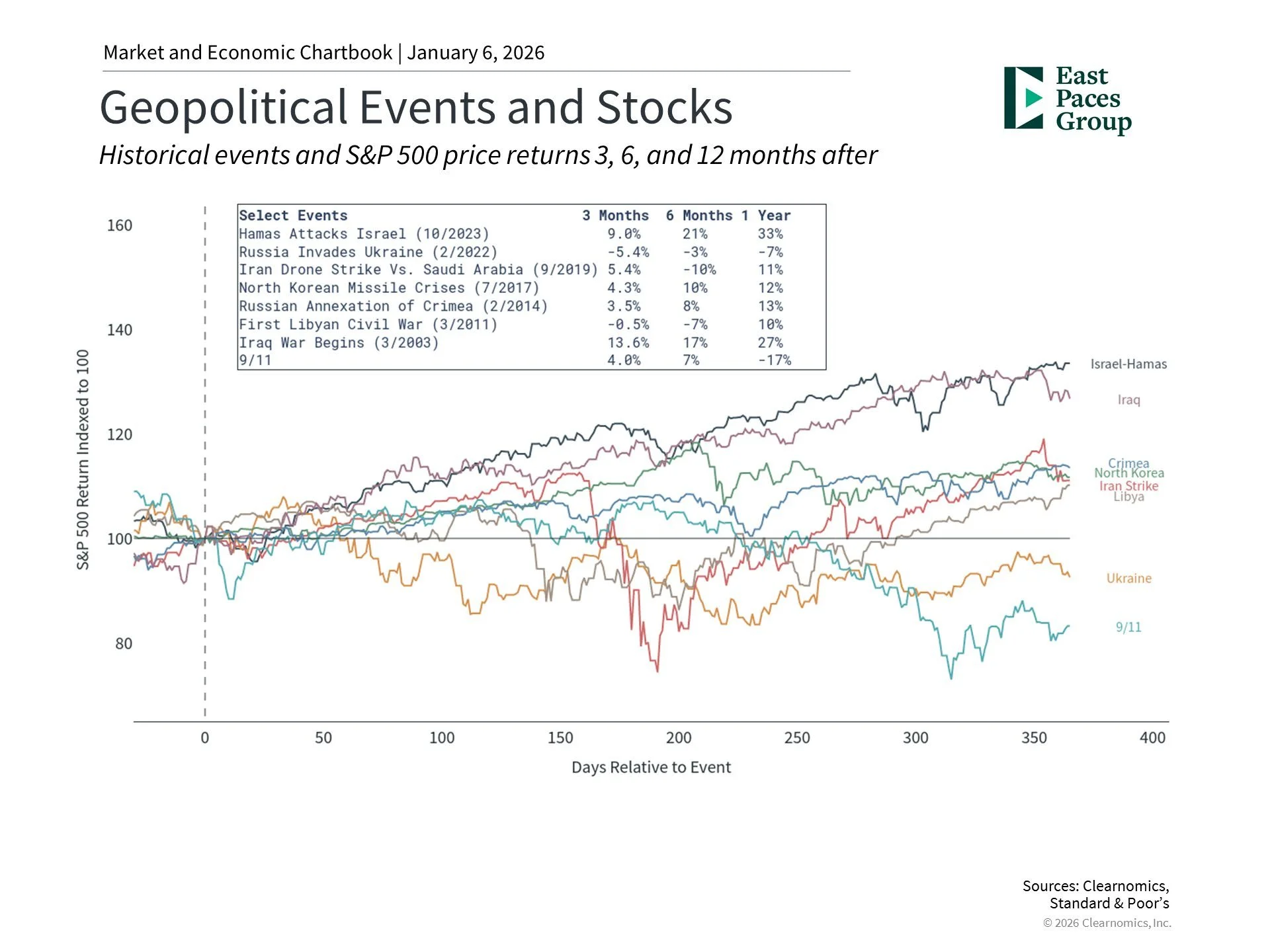

History shows geopolitical events frequently lead to short-term volatility, but their long-term market impact tends to be modest, even when they involve major conflict or political disruption. Investors are usually better served by maintaining a long-term portfolio strategy than trying to trade around geopolitical headlines.

The chart to the right shows key historical events and S&P 500 price returns up to 12 months after.

The Primary Market Link: Oil Prices

The most direct market mechanism remains oil. Venezuela holds the world’s largest confirmed oil reserves, but production has collapsed over the last two decades due to infrastructure issues, poor management, and sanctions. Even if the U.S. pursues expanded production in Venezuela, meaningful output increases would require time and capital investment—limiting immediate market impacts.

Venezuela’s Limited Presence in Global Portfolios

Direct exposure for most investors remains low: Venezuela’s stock exchange is small and absent from major emerging market indexes; Venezuelan sovereign debt has been in default since 2017; and any impact is far more likely to come indirectly through oil prices or headline-driven volatility.

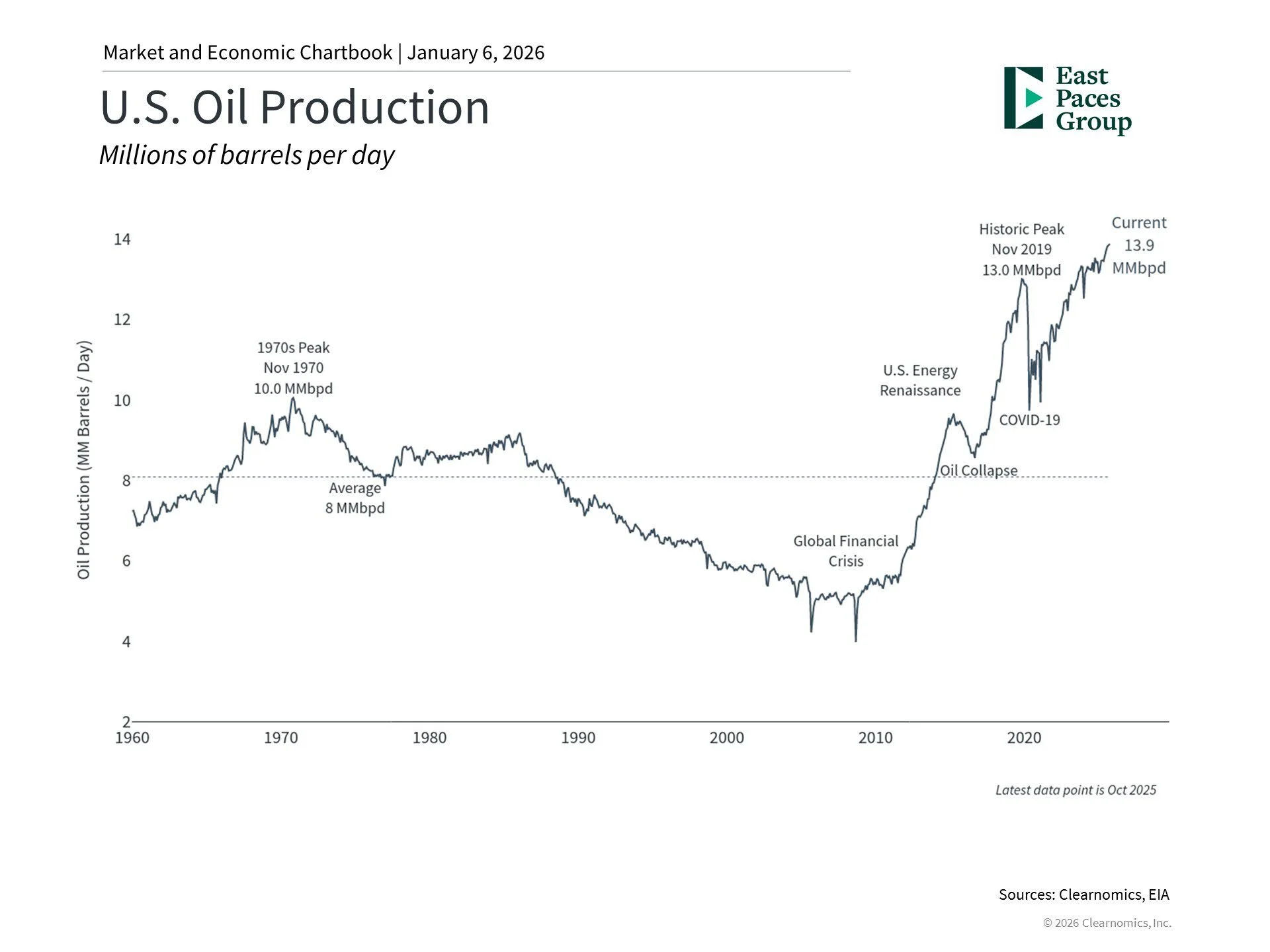

The chart to the right indicates U.S. oil production trends over the last 65 years. The U.S. became the top oil producer in the world due to the shale revolution and new technologies. U.S. oil production is now above pre-pandemic levels after years of depressed activity.

The Bottom Line for Investors

2025 reinforced the value of staying disciplined through uncertainty. Entering 2026, the market environment remains constructive, but higher valuations and moderating growth suggest tempering return expectations.

Geopolitical developments—including Venezuela—can create short-term volatility, but history suggests that portfolios aligned with long-term objectives can navigate these periods effectively.

Our focus remains:

Diversification across asset classes and geographies

Maintaining risk alignment with long-term goals

Planning around what we can control (tax, savings, allocation) rather than reacting to headlines

If you’d like to discuss how these themes relate to your portfolio positioning and planning strategy for the year ahead, we are always happy to connect.